Consolidation

In Corporate Planner Cons you can quickly and easily prepare your consolidated financial statements for audit.

With our software solution for management and legal consolidation in companies that are structured in groups, you always have a clear overview of your group companies with all their subsidiaries. A workflow

guides the user step by step through the entire consolidation process. With its built-in business logic, Corporate Planner Cons checks the plausibility of your input and generates the lists of your consolidation postings automatically. An audit trail logs all the parameters of relevance to the group, thereby providing

additional reliability.

Your advantages:

- Workflow guidance for audit-ready consolidation

- Certified according to recognized audit standards

- Information delivered on demand thanks to fast close

- Parallel accounting according to local GAAP and IAS/IFRS

- Seamless connection to financial planning

Contact us

Fast close for information on demand

Increase external stakeholder confidence in your business. Consolidated financial statements prepared during the course of the year put you in a position to deliver information on demand and to respond quickly to new situations. With our software for consolidation, you can produce your financial statements quickly and to a high standard of quality.

Auditable consolidated financial statements

Get your documents ready for audit quickly. Our solution is built on business administration expertise with which you generate your lists of postings automatically. In addition, an optional audit trail keeps a record of all the changes made in rights management. Our consolidation software has been certified according to audit standards.

The bridge to financial planning

Create a successful team with your colleagues in integrated financial planning. Our solutions for consolidation and financial planning are fully integrated.

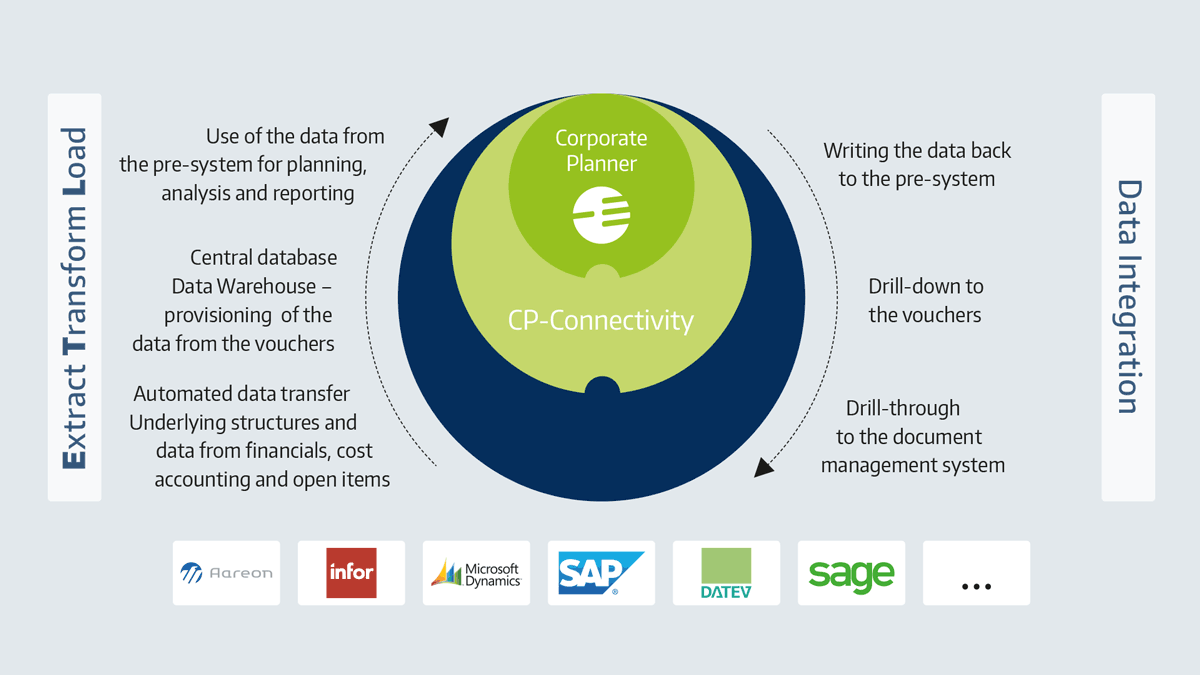

Seamlessly connected to your system environment

Our integrations build reliable connections between any pre-systems – ERP systems, software for financial and cost accounting, and the payroll processing software used in human resource management, for instance – and the Corporate Planning software.

Corporate Performance Management Software at Work

What do the Corporate Planning software solutions achieve in practice? – Nobody's better placed to tell us than the companies working with it every day.

Here's an overview of some of our customers' impressions.

Corporate Planning won us over by being excellent value for money.

Olaf Brüggemann

Group Commercial Director, Jacob Waitz Industrie GmbH

The particularly attractive, user-friendly and process-orientated approach to operating the software was what ultimately convinced us about Corporate Planner Cons.

Manuel Erndwein

Head of Group Accounting & Controlling, IDS-Gruppe Holding GmbH

Matthias Brink

Head of Controlling, ELA Container GmbH

By integrating and establishing certain standards, new companies can be included in the uniform reporting system and consolidation immediately.